Federal Budget – Get the LowDown

On Wednesday, March 22nd at 4 pm, Bill Morneau, Federal Minister of Finance, delivered his Federal budget in the House of Commons. The budget is titled “Building a Strong Middle Class”.

What you Need to Know

The Federal budget was described as a “wait-and-see” budget by CBC news, with a significant amount of political uncertainty, and lack of information regarding corporate and personal tax cuts and government spending emanating from the United States.

There is a fear that Canada could experience a brain-drain of highly educated and talented leaders if they are attracted to the US by greater job opportunities, higher pay and lower taxes. Budget 2017 did little to address the concerns of highly capable Canadians.

but it did not increase the income tax burden for them either.

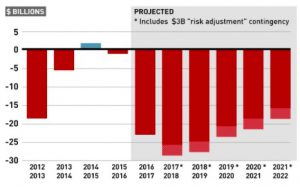

- Overall budget deficits will remain much higher than during the Liberal’s successful political campaign. The annual budget deficit will likely be around $18 billion in 2021/22.

- Unemployment insurance premiums are being raised by their maximum amount to $1.68 for every $100 of insurable earnings.

- Taxes on tobacco and alcohol will be adjusted every April 1st, and be linked to the Consumer Price Index. This will begin in 2018, after a 2017 increase has been mandated within the budget.

- Public Transit Tax Credit will be eliminated on July 1st .

- The Canada Savings Bond program will be eliminated.

- An additional $3.4 billion will be spent to improve living condition for First Nations peoples over the next five years.

- Over $500 million will be spent over the next 5 years to prevent tax evasion.

- A national housing strategy will cost over $11 billion over the next 11 years.

- $7 billion will be spent in the next decade to assist Canadian families by increasing the number of daycare spots, lengthening parental leave, and allowing maternal leave to begin 12 weeks before the expected due date.

- Female entrepreneurs received additional funding and the tax treatment of fertility procedures and treatment was made more favourable.

- Nearly $3 billion before 2023 to work with the provinces and territories to improve support to unemployed Canadians through better training.

- $400 million over 3 years to fund a venture capital initiative through the Business Development Bank to increase access to capital for entrepreneurs.

- Spending review of three (to be named later) departments to eliminate waste and inefficiencies.

- Uber and other ride sharing services will be subject to GST.

- Announced, but not articulated, is the government’s intention to review tax and compensation arrangements for small business corporations regarding income splitting with dividends and capital gains, holding passive (non-operating) investments, and converting salary or dividends to capital gains.